Does Land Qualify For Qbi . Determine if your rental income qualifies for the qbi deduction, including eligibility criteria, limitations, and strategic considerations for landlords. With respect to the real estate industry, one of the most important provisions is the limitation based on 25% of wages and 2.5% of unadjusted basis immediately after acquisition of qualified property or ubia. Tangible property of a character subject to depreciation that is. With the passage of the tax cuts and jobs act (tcja) of 2017, many real estate investors are wondering whether rental income qualifies for the generous, yet confusing, section 199a. Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified business income (qbi).

from www.chegg.com

With respect to the real estate industry, one of the most important provisions is the limitation based on 25% of wages and 2.5% of unadjusted basis immediately after acquisition of qualified property or ubia. With the passage of the tax cuts and jobs act (tcja) of 2017, many real estate investors are wondering whether rental income qualifies for the generous, yet confusing, section 199a. Tangible property of a character subject to depreciation that is. Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified business income (qbi). Determine if your rental income qualifies for the qbi deduction, including eligibility criteria, limitations, and strategic considerations for landlords.

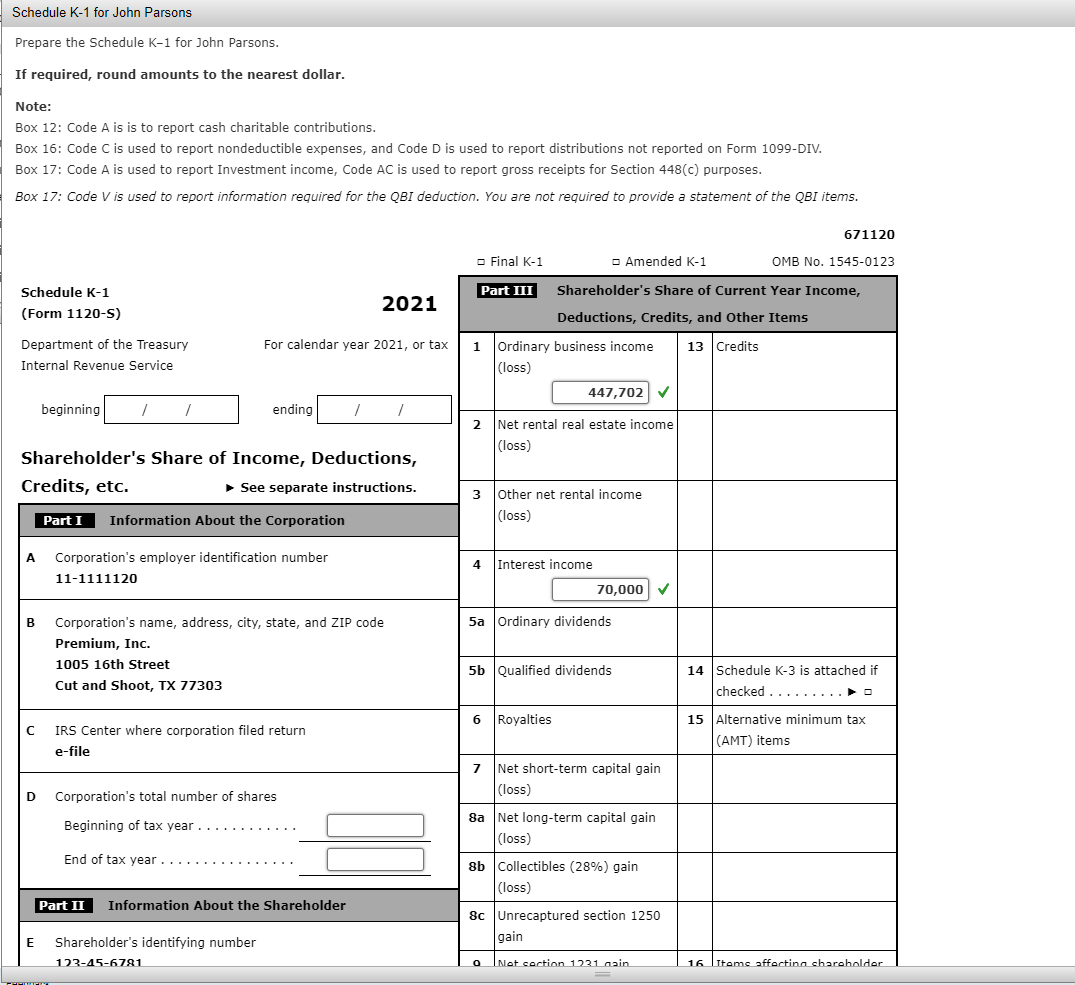

Note This problem is for the 2021 tax year. John

Does Land Qualify For Qbi With respect to the real estate industry, one of the most important provisions is the limitation based on 25% of wages and 2.5% of unadjusted basis immediately after acquisition of qualified property or ubia. Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified business income (qbi). With the passage of the tax cuts and jobs act (tcja) of 2017, many real estate investors are wondering whether rental income qualifies for the generous, yet confusing, section 199a. Tangible property of a character subject to depreciation that is. Determine if your rental income qualifies for the qbi deduction, including eligibility criteria, limitations, and strategic considerations for landlords. With respect to the real estate industry, one of the most important provisions is the limitation based on 25% of wages and 2.5% of unadjusted basis immediately after acquisition of qualified property or ubia.

From answermagicdiane.z21.web.core.windows.net

How To Calculate Eligible Basis Lihtc Does Land Qualify For Qbi Tangible property of a character subject to depreciation that is. With respect to the real estate industry, one of the most important provisions is the limitation based on 25% of wages and 2.5% of unadjusted basis immediately after acquisition of qualified property or ubia. Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible. Does Land Qualify For Qbi.

From ttlc.intuit.com

Do I qualify for the qualified business deduction? Does Land Qualify For Qbi With the passage of the tax cuts and jobs act (tcja) of 2017, many real estate investors are wondering whether rental income qualifies for the generous, yet confusing, section 199a. Determine if your rental income qualifies for the qbi deduction, including eligibility criteria, limitations, and strategic considerations for landlords. With respect to the real estate industry, one of the most. Does Land Qualify For Qbi.

From www.youtube.com

How to File IRS Form 8995 for Qualified Business (QBI) Deduction Does Land Qualify For Qbi Determine if your rental income qualifies for the qbi deduction, including eligibility criteria, limitations, and strategic considerations for landlords. With the passage of the tax cuts and jobs act (tcja) of 2017, many real estate investors are wondering whether rental income qualifies for the generous, yet confusing, section 199a. Many owners of sole proprietorships, partnerships, s corporations and some trusts. Does Land Qualify For Qbi.

From tqdlaw.com

Do You Qualify for a Qualified Business (QBI) Deduction? Dahl Does Land Qualify For Qbi Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified business income (qbi). Tangible property of a character subject to depreciation that is. With respect to the real estate industry, one of the most important provisions is the limitation based on 25% of wages and 2.5% of unadjusted basis immediately after. Does Land Qualify For Qbi.

From www.chegg.com

Note This problem is for the 2021 tax year. John Does Land Qualify For Qbi With respect to the real estate industry, one of the most important provisions is the limitation based on 25% of wages and 2.5% of unadjusted basis immediately after acquisition of qualified property or ubia. Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified business income (qbi). Determine if your rental. Does Land Qualify For Qbi.

From alloysilverstein.com

Do I Qualify for the Qualified Business (QBI) Deduction? Alloy Does Land Qualify For Qbi Tangible property of a character subject to depreciation that is. Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified business income (qbi). With respect to the real estate industry, one of the most important provisions is the limitation based on 25% of wages and 2.5% of unadjusted basis immediately after. Does Land Qualify For Qbi.

From www.youtube.com

Does my rental qualify for the 20 QBI deduction? YouTube Does Land Qualify For Qbi With respect to the real estate industry, one of the most important provisions is the limitation based on 25% of wages and 2.5% of unadjusted basis immediately after acquisition of qualified property or ubia. With the passage of the tax cuts and jobs act (tcja) of 2017, many real estate investors are wondering whether rental income qualifies for the generous,. Does Land Qualify For Qbi.

From www.youtube.com

Do You Qualify for QBI Deduction? Know The Detailed Requirements YouTube Does Land Qualify For Qbi Determine if your rental income qualifies for the qbi deduction, including eligibility criteria, limitations, and strategic considerations for landlords. With respect to the real estate industry, one of the most important provisions is the limitation based on 25% of wages and 2.5% of unadjusted basis immediately after acquisition of qualified property or ubia. Tangible property of a character subject to. Does Land Qualify For Qbi.

From how2-know.com

Does Farm Rental Qualify for QBI How2Know Does Land Qualify For Qbi Determine if your rental income qualifies for the qbi deduction, including eligibility criteria, limitations, and strategic considerations for landlords. Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified business income (qbi). Tangible property of a character subject to depreciation that is. With the passage of the tax cuts and jobs. Does Land Qualify For Qbi.

From www.drakesoftware.com

Does My Client Qualify for QBI? Taxing Subjects Does Land Qualify For Qbi With the passage of the tax cuts and jobs act (tcja) of 2017, many real estate investors are wondering whether rental income qualifies for the generous, yet confusing, section 199a. With respect to the real estate industry, one of the most important provisions is the limitation based on 25% of wages and 2.5% of unadjusted basis immediately after acquisition of. Does Land Qualify For Qbi.

From www.gleim.com

Section 199A Qualified Business Deduction (QBID) Gleim Exam Prep Does Land Qualify For Qbi With respect to the real estate industry, one of the most important provisions is the limitation based on 25% of wages and 2.5% of unadjusted basis immediately after acquisition of qualified property or ubia. Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified business income (qbi). With the passage of. Does Land Qualify For Qbi.

From slideplayer.com

Presented by Martin C. Levin, CPA CVA MBA ppt download Does Land Qualify For Qbi Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified business income (qbi). With the passage of the tax cuts and jobs act (tcja) of 2017, many real estate investors are wondering whether rental income qualifies for the generous, yet confusing, section 199a. Determine if your rental income qualifies for the. Does Land Qualify For Qbi.

From amynorthardcpa.com

How to Make Your Rental Property Qualify for the QBI Deduction Does Land Qualify For Qbi Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified business income (qbi). With respect to the real estate industry, one of the most important provisions is the limitation based on 25% of wages and 2.5% of unadjusted basis immediately after acquisition of qualified property or ubia. Determine if your rental. Does Land Qualify For Qbi.

From www.chegg.com

Qualified Business (QBI) Deduction (LO 4.11) Does Land Qualify For Qbi Determine if your rental income qualifies for the qbi deduction, including eligibility criteria, limitations, and strategic considerations for landlords. With the passage of the tax cuts and jobs act (tcja) of 2017, many real estate investors are wondering whether rental income qualifies for the generous, yet confusing, section 199a. Tangible property of a character subject to depreciation that is. With. Does Land Qualify For Qbi.

From flyfin.tax

How To Claim SelfEmployment Business Deductions FlyFin Does Land Qualify For Qbi Tangible property of a character subject to depreciation that is. Determine if your rental income qualifies for the qbi deduction, including eligibility criteria, limitations, and strategic considerations for landlords. Many owners of sole proprietorships, partnerships, s corporations and some trusts and estates may be eligible for a qualified business income (qbi). With respect to the real estate industry, one of. Does Land Qualify For Qbi.

From tallytaxman.com

Does Rental Property Qualify for the 20 QBI Deduction? TallyTaxMan Does Land Qualify For Qbi Determine if your rental income qualifies for the qbi deduction, including eligibility criteria, limitations, and strategic considerations for landlords. With the passage of the tax cuts and jobs act (tcja) of 2017, many real estate investors are wondering whether rental income qualifies for the generous, yet confusing, section 199a. Tangible property of a character subject to depreciation that is. Many. Does Land Qualify For Qbi.

From www.chegg.com

Solved bona infombon from Form 11205 Continuation State Does Land Qualify For Qbi With the passage of the tax cuts and jobs act (tcja) of 2017, many real estate investors are wondering whether rental income qualifies for the generous, yet confusing, section 199a. With respect to the real estate industry, one of the most important provisions is the limitation based on 25% of wages and 2.5% of unadjusted basis immediately after acquisition of. Does Land Qualify For Qbi.

From gavtax.com

Does Rental Qualify for the 20 QBI deduction GavTax Advisory Does Land Qualify For Qbi Determine if your rental income qualifies for the qbi deduction, including eligibility criteria, limitations, and strategic considerations for landlords. With the passage of the tax cuts and jobs act (tcja) of 2017, many real estate investors are wondering whether rental income qualifies for the generous, yet confusing, section 199a. Tangible property of a character subject to depreciation that is. With. Does Land Qualify For Qbi.